Reviewing the consumer spending impacts of Hurricane Milton

2024 has been a busy tropical storm and hurricane season to date with 17 named storms, 11 hurricanes, 5 major hurricanes, and 11 landfalling systems in the U.S. through early November. This included Hurricane Milton, a Category 5 storm (the highest severity classification possible), which rapidly intensified in early October with wind speeds topping 180MPH, making it one of the most intense Atlantic hurricanes ever recorded. Milton significantly damaged the economy and brought notable disruption to people and business alike before, throughout, and following the storm.

Hurricanes and other severe weather events have large impacts on the local economies and commercial activity. The National Oceanic and Atmospheric Administration (NOAA) noted 28 separate weather and climate disasters in 2023 that cost at least $1 billion dollars, a record for the U.S. in a single calendar year. NOAA year-to-date report shows that 2024 will have a similar number of $1 billion+ events.

“Major storms and extreme events are typically the first thing retailers map to when considering the weather’s business impacts,” noted the National Retail (NRF) in its Climate-Proofing Retail whitepaper. The NRF paper points out that events reaching the billion-dollar threshold “now happen every three weeks compared to once every four months in the 1980s.”

Consumer Spending Ahead of Hurricane Milton

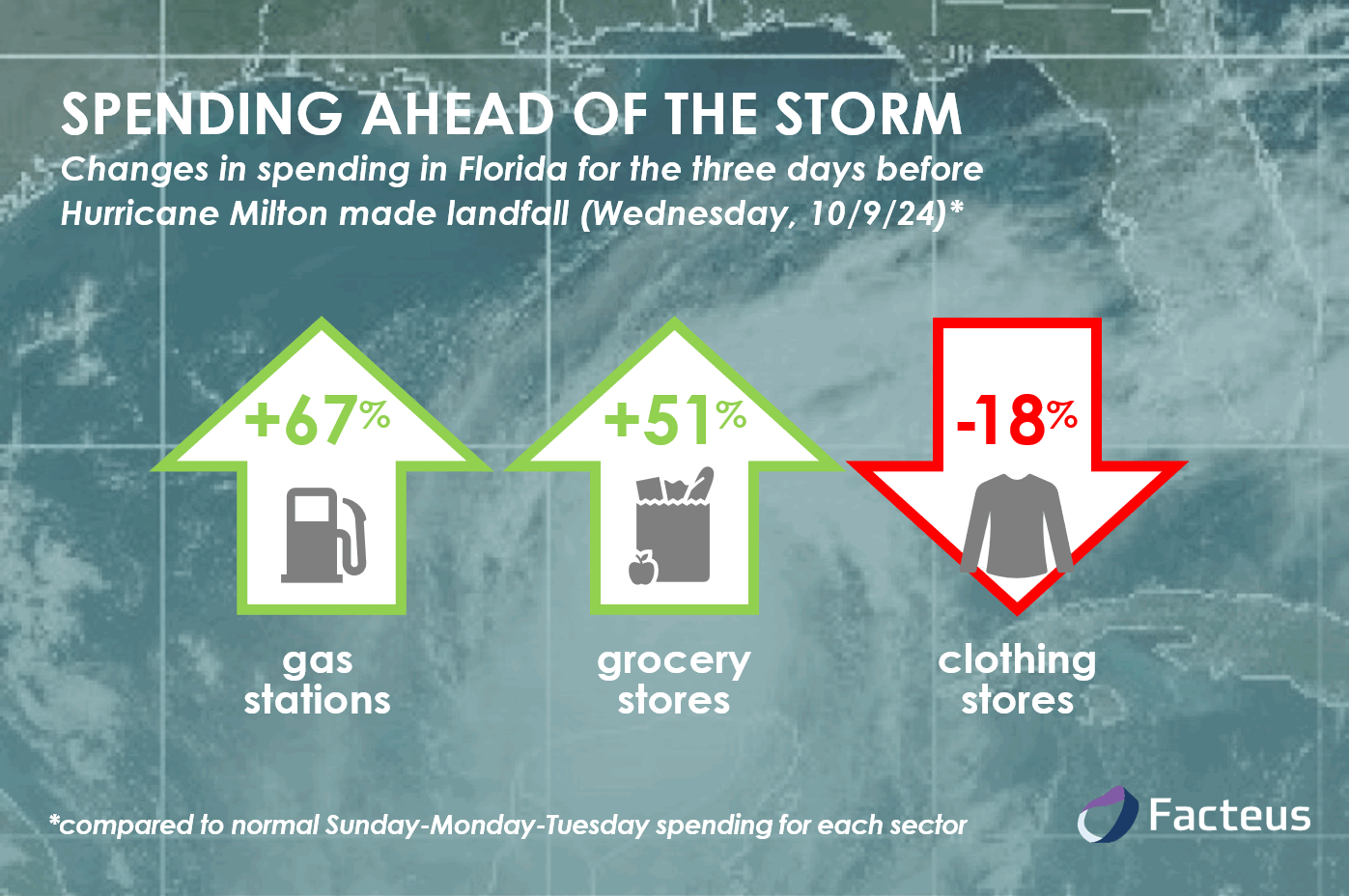

Planalytics has partnered with Facteus, a leader in alternative data, to provide consumer spending analytics that isolate, quantify, and forecast the impacts of weather on purchasing. Facteus’ retail spending data for Florida in the days preceding Hurricane Milton (which made landfall on October 9th) confirms the dramatic change in buying behavior around extreme weather events.

As expected, an approaching hurricane prioritizes need-based purchasing at the expense of discretionary items. Grocery stores (+51%) and gas stations (+67%) saw a surge of store traffic in the three days ahead of landfall as people either prepared to be homebound for a few days and stocked up on foods and household staples or, alternatively, to jump into their cars to move further away from the storm. Updating the wardrobe for fall and winter took a backseat.

How did an approaching Milton impact spending on specific items?

Planalytics’ Weather-Driven Demand (WDD) metrics calculate how much the weather alone increases or decreases demand for product categories. WDDs in Florida jumped between +30% and +150% compared to normal for many storm prep items including bottled water, filled propane tanks, tarps, water pumps, batteries, canned soup, and rainwear as Milton barreled down on the state. On the other hand, traffic into traditional department, clothing, sporting goods, and shoe stores dried up and seasonal categories from fleece to jackets to boots saw negative WDD impacts of -10% to -40% during the week.

Post-Hurricane Impacts

The home center/hardware store segment often see increased traffic and spending after the storm has passed and consumers focus on clean-up, repairs, or buying replacement products. This post-event spending boost can be significant, producing incremental sales gains in select categories for weeks or even months. Planalytics and Facteus data showed a +8% weather-driven spending increase for the sector across Florida the week after Hurricane Milton passed through.

Grocery store sales will crater for a day or two but tend to rebound to normal levels quickly. As the storm hits, customer traffic to restaurants and entertainment venues will also dry up temporarily but some sales are never recovered. And for businesses that sell merchandise that was deprioritized as shoppers focused on need-based purchases (clothing stores and other specialty segments), most sales tend to only be delayed with demand normalizing within a few days or weeks. However, while sales in these sectors are generally recouped, lost sales can occur if consumers must redirect their budgets to major repairs or replacement products. If sales are delayed, retailers also may need to use markdowns – and sacrifice margin – to address bloated inventories as they move closer to the end of the selling season.

For more examples, check out Facteus’ article: Hurricanes and Consumers: The Power of Granularity in Understanding Consumer Behavior.

Using Weather-Informed Predictive Analytics to Manage Opportunities and Risks

While extreme weather events like Hurricane Milton have major impacts on a retailer’s daily operations, everyday weather changes also play a large role in retail performance. Leveraging analytics to measure precisely how the conditions outside have and will affect operations is a necessary first step to more effectively manage never-ending weather-driven sales volatility. Planalytics and Facteus provide company-specific and sector-based analytics that calculate the impacts, enabling retailers to position the business to capture sales when the weather creates opportunities and to manage costs when risks emerge.

To learn more about the analytics Facteus and Planalytics offers, please contact us for more information.